The latest news, trends, analysis, interviews and podcasts from the global food and beverage industry

As consumers seek to diversify their at-home meals and snack, which includes engaging with more protein types and formats, protein brands have room to grow into the categories where they currently have limited presence.

Covid-19 has forced people to stay at home for extended periods. But even as foodservice reopens, it is likely to be years before out-of-home channels recover to 2019 footfall levels due to ongoing social distancing measures and consumer anxieties. This means consumers will be seeking to diversify their in-home protein routines beyond the centre of the plate in the years to come, offering room for protein players to expand their category offerings to keep people engaged.

There’s an opportunity to not only expand into sandwiches/wraps, prepared meals and snacks, but also explore areas where protein is not usually top of mind such as sauces and hot beverages. Brands can strengthen their convenience positioning by providing great tasting and easy-to-prepare protein offerings, with targeted messaging for distinct consumer groups.

Protein sweet spot

In a world where high protein continues to reign as a health attribute of interest, many consumers are not looking for drinks that extend to the highest reaches of the protein spectrum.

Increasingly consumers are becoming more knowledgeable about protein and its benefits, and seek out only what makes sense for their needs. It may also be that these consumers are consuming high protein products with greater frequency, and thus, don’t need any one product to give them all the protein they need for the day. Instead, they may be consuming moderate protein levels throughout the day to meet their desired intake.

Education around protein and clear options based on intended consumption frequency will serve the less knowledgeable consumers and perhaps help them feel more engaged in the category, and make room for a range of low, medium, and high protein products to be turned to by different users for different needs.

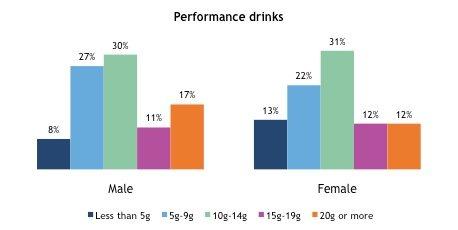

Figure 1: Mintel Amount of protein sought per serving, by gender, 2022 Base: 615 internet users aged 18+ who use sports drinks; 422 internet users aged 18+ who use performance drinks.

What amount of protein per serving do you typically look for in the following drinks?

An exception to the protein moderation discussed above is men who consume performance drinks. Close to one in five male performance drink users want 20g protein/serving, and high protein claims will directly resonate with this group and will be clear means of helping products stand apart from competitors.

One way to bring older consumers into the category is to highlight the benefit of protein to ageing bodies. Here, efforts that go beyond simply promoting high protein will be important to stand out in a sea of high protein food and drink offerings. This group will want to know exactly how the protein benefits them.

Consuming the recommended protein intake in an ageing population may improve muscle health, prevent sarcopenia, help maintain energy balance, weight management and cardiovascular function, which should appeal to the 52% of consumers that have adopted a more long-term approach to health in the last 2 years.

To find out more on how Carbery is developing whey protein ingredients that meet a wide range of functional and nutritional requirements for today’s consumer, click here.